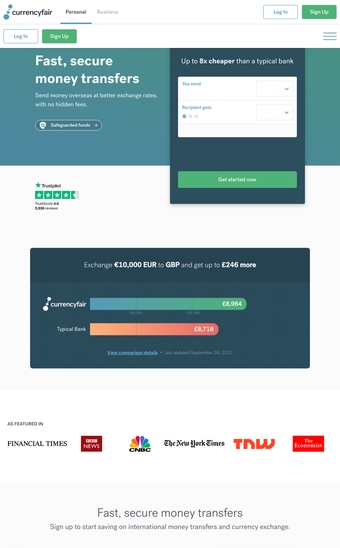

CurrencyFair

currencyfair.comCurrencyFair is an online peer-to-peer currency exchange marketplace that provides international transfers in 18 countries worldwide. Like TransferWise, CurrencyFair avoids excessive bank fees by matching transfers with someone who has a corresponding need, meaning money never physically crosses borders. First launched in 2009, the platform is available on both desktop and as a free smartphone application for Android and iOS.

CurrencyFairs is easy to use, simply requiring users to set up an account, select the amount they wish to send and which currency they’d like the recipient to receive the payment in and sending the money over to the CurrencyFair bank account.

There is a small service fee of $4 USD that does not change, regardless of the amount sent. This differs significantly from other services, such as PayPal, who charge 3% of the total amount sent, plus their own exchange rate. CurrencyFair, meanwhile use the market exchange rate, meaning you are always guaranteed to get the best rate available without being surprised by any hidden costs. I find this transparency in sending money to be one of the best aspects of the service.

Another facet of the service that I especially like is the ability to set alerts to notify the recipient of the status of the transfer. This provides reassurance that their money is on its way and in safe hands, or if there has been some form of delay. It saves me time every time I send money as I do not have to write my own email informing them that I have sent the money and when I hope for it to arrive.

A downside to platform is the difficulty in withdrawing money once it has been sent to the CurrencyFair account. For example, if you have sent more than was required, it can be quite difficult in putting it back into your bank account.

CurrencyFair is an online peer-to-peer currency exchange marketplace that provides international transfers in 18 countries worldwide. Like TransferWise, CurrencyFair avoids excessive bank fees by matching transfers with someone who has a corresponding need, meaning money never physically crosses borders. First launched in 2009, the platform is available on both desktop and as a free smartphone application for Android and iOS.

CurrencyFairs is easy to use, simply requiring users to set up an account, select the amount they wish to send and which currency they’d like the recipient to receive the payment in and sending the money over to the CurrencyFair bank account.

There is a small service fee of $4 USD that does not change, regardless of the amount sent. This differs significantly from other services, such as PayPal, who charge 3% of the total amount sent, plus their own exchange rate. CurrencyFair, meanwhile use the market exchange rate, meaning you are always guaranteed to get the best rate available without being surprised by any hidden costs. I find this transparency in sending money to be one of the best aspects of the service.

Another facet of the service that I especially like is the ability to set alerts to notify the recipient of the status of the transfer. This provides reassurance that their money is on its way and in safe hands, or if there has been some form of delay. It saves me time every time I send money as I do not have to write my own email informing them that I have sent the money and when I hope for it to arrive.

A downside to platform is the difficulty in withdrawing money once it has been sent to the CurrencyFair account. For example, if you have sent more than was required, it can be quite difficult in putting it back into your bank account.